Sales Tax in Peachtree

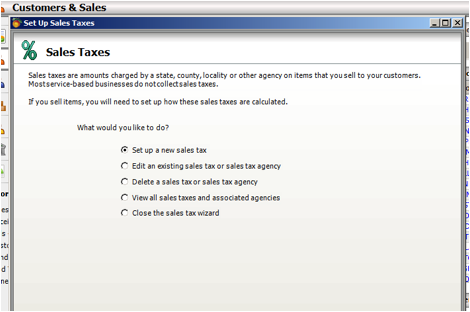

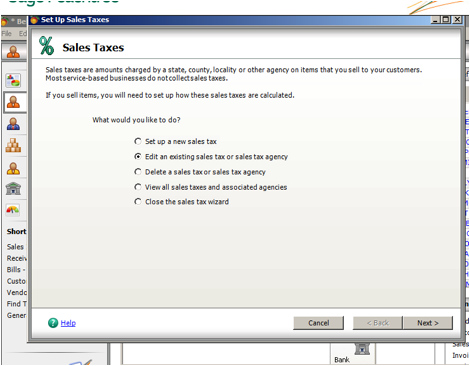

When you add a new item to sell to your Peachtree system, you will also need to setup the necessary sales tax. In order to designate sales taxes for purchases, choose “Customers & Sales” from the menu on the left side of the screen. In the “Customers & Sales” pane select “Sales Tax.” You will be asked to set up a new tax, edit an existing tax, delete a tax, view taxes, or close the wizard.

To setup a new sales tax:

Select “Set Up a New Sales Tax” (Default)

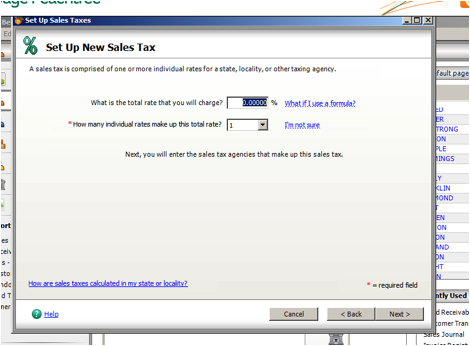

You will need two pieces of information to complete the next screen: 1.) total rate to be charged and 2.) individual rates that make up the total rate. Note that you cannot complete the addition of a new tax without knowing the number of individual rates. When you are finished entering this information, click <Next>.

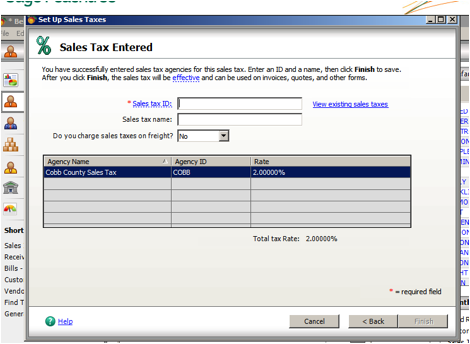

You will then be asked to enter the agency information. Note that required fields are indicated by an asterisk. You will need to know the agency id, method the agency uses to calculate sales taxes, tax rate, and the account that will track the taxes.

Click <Next>

A screen will appear that indicates you have successfully entered tax information.

Click <Finish>. You will be returned to the original screen where you may choose to enter additional tax information or close the wizard if you are finished.

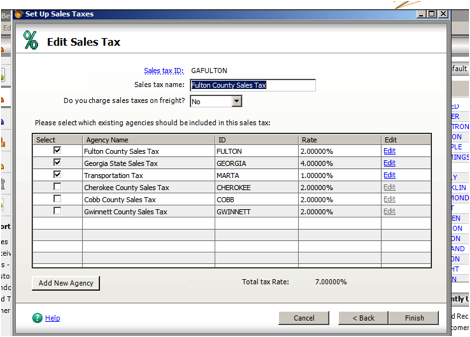

To edit an existing tax:

Choose “Edit an Existing Sales Tax or Sales Tax Agency”

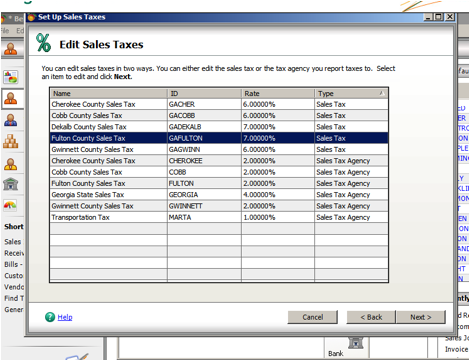

Highlight the tax agency you wish to edit and click <Next>.

Edit the tax information. Required fields are denoted by an asterisk. When you are finished, click <Next>. You can then edit another tax agency, enter a new task, or exit the tax screen by choosing to close the tax wizard.